Buying Education And Learning: The Importance of Save for College Plans

Buying Education And Learning: The Importance of Save for College Plans

Blog Article

Maximizing Your University Financial Savings: Secret Financial Planning Techniques

As the expense of university continues to increase, it comes to be increasingly crucial to create effective monetary preparation strategies to maximize your university financial savings. In this discussion, we will check out vital financial planning methods that can aid you browse the complexities of college cost savings and guarantee you are well-prepared for the trip in advance.

Beginning Saving Early

To take full advantage of the possible development of your university savings, it is important to start conserving early in your economic preparation journey. Starting early allows you to benefit from the power of intensifying, which can substantially increase your savings in time. By starting early, you provide your money more time to benefit and grow from the returns generated by your investments.

When you begin saving for college early, you can also take advantage of various tax-advantaged savings vehicles, such as 529 strategies or Coverdell Education and learning Financial Savings Accounts. These accounts supply tax obligation advantages that can assist you save much more efficiently for college expenses. Additionally, beginning very early provides you the chance to contribute smaller quantities over a longer duration, making it a lot more workable and less challenging on your spending plan.

An additional advantage of starting very early is that it enables you to set reasonable savings objectives. By having a longer time horizon, you can better intend and change your cost savings strategy to fulfill your university funding demands. This can assist minimize stress and give satisfaction knowing that you get on track to accomplish your savings objectives.

Discover Tax-Advantaged Savings Options

529 plans are prominent tax-advantaged financial savings choices that supply a variety of investment options and tax advantages. Contributions to a 529 strategy expand tax-free, and withdrawals for certified education and learning expenditures are additionally tax-free. Coverdell ESAs, on the various other hand, permit payments of approximately $2,000 each year per recipient and deal tax-free development and withdrawals for qualified education expenses.

Set Sensible Conserving Goals

Developing realistic saving objectives is a vital action in effective monetary preparation for college costs. When it involves saving for college, it is essential to have a clear understanding of the expenses included and established achievable goals. By setting sensible conserving objectives, you can ensure that you are on track to satisfy your economic demands and avoid unnecessary tension.

To start, it is critical to estimate how much you will need to save for university. Take into consideration variables such as tuition fees, textbooks, accommodation, and other various costs. Investigating the typical expenses of colleges and universities can supply you with a standard for establishing your conserving goals.

When you have a clear idea of the amount you need to save, simplify into smaller, manageable objectives. Establish month-to-month or annual targets that line up with your present monetary circumstance and income. This will help you remain inspired and track Get More Info your progress in time.

Furthermore, take into consideration making use of devices such as university savings calculators or dealing with a financial advisor to acquire a deeper understanding of your saving potential (Save for College). They can offer important insights and assistance on how to optimize your savings technique

Consider Different Investment Strategies

When planning for university financial savings, it is essential to discover numerous financial investment methods to optimize the development of your funds. Investing in the right strategies can aid you attain your cost savings goals and provide economic protection for your kid's education.

One common financial investment method is to open a 529 college financial savings plan. This plan supplies tax obligation advantages and permits you to spend click to find out more in a variety of financial investment alternatives such as stocks, bonds, and common funds. The incomes in a 529 plan expand tax-free, and withdrawals utilized for qualified education and learning costs are also tax-free.

An additional technique to consider is spending in a Coverdell Education Interest-bearing Account (ESA) Like a 529 plan, the revenues in a Coverdell ESA grow tax-free, and withdrawals are tax-free when used for certified education costs. However, the payment limit for a Coverdell ESA is lower contrasted to a 529 strategy.

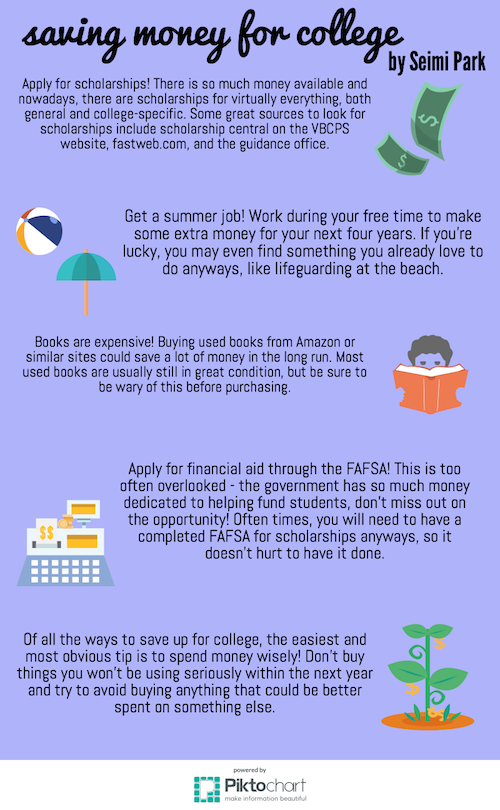

Benefit From Scholarships and Grants

To even more enhance your college savings strategy, it is essential to take advantage of on the opportunities presented by try these out gives and scholarships. Scholarships and gives are economic aids offered by various institutions and companies to aid pupils cover their college expenses. Unlike lendings, gives and scholarships do not need to be repaid, making them a superb alternative to decrease the financial worry of college.

Scholarships are typically granted based on merit, such as scholastic accomplishments, sports capabilities, or artistic abilities. They can be provided by universities, personal organizations, or federal government entities. It is important to study and obtain scholarships that align with your staminas and interests. Lots of scholarships have particular qualification criteria, so make certain to check the needs and deadlines.

Grants, on the various other hand, are usually need-based and are provided to pupils who show economic need. These grants can originate from government or state governments, colleges, or exclusive companies. To be considered for gives, pupils often need to finish the Free Application for Federal Pupil Help (FAFSA) to determine their eligibility.

Making use of scholarships and gives can considerably minimize the quantity of cash you require to save for college. It is important to start investigating and using for these financial aids well beforehand to boost your possibilities of obtaining them. By meticulously considering your options and putting in the effort to choose scholarships and grants, you can make a significant effect on your college savings technique.

Final Thought

In verdict, optimizing college savings calls for early planning and discovering tax-advantaged cost savings options. By implementing these key monetary preparation strategies, people can ensure they are well-prepared for their university education and learning.

As the expense of university continues to rise, it comes to be significantly essential to develop efficient financial preparation techniques to optimize your college financial savings. In this discussion, we will certainly check out vital monetary preparation techniques that can aid you navigate the intricacies of college cost savings and guarantee you are well-prepared for the journey in advance.When you begin conserving for university early, you can also take benefit of various tax-advantaged cost savings lorries, such as 529 plans or Coverdell Education and learning Savings Accounts.As you think about the relevance of starting early in your university financial savings journey, it is vital to explore the different tax-advantaged financial savings options offered to optimize your financial savings potential.In final thought, maximizing college cost savings calls for very early planning and checking out tax-advantaged cost savings alternatives.

Report this page